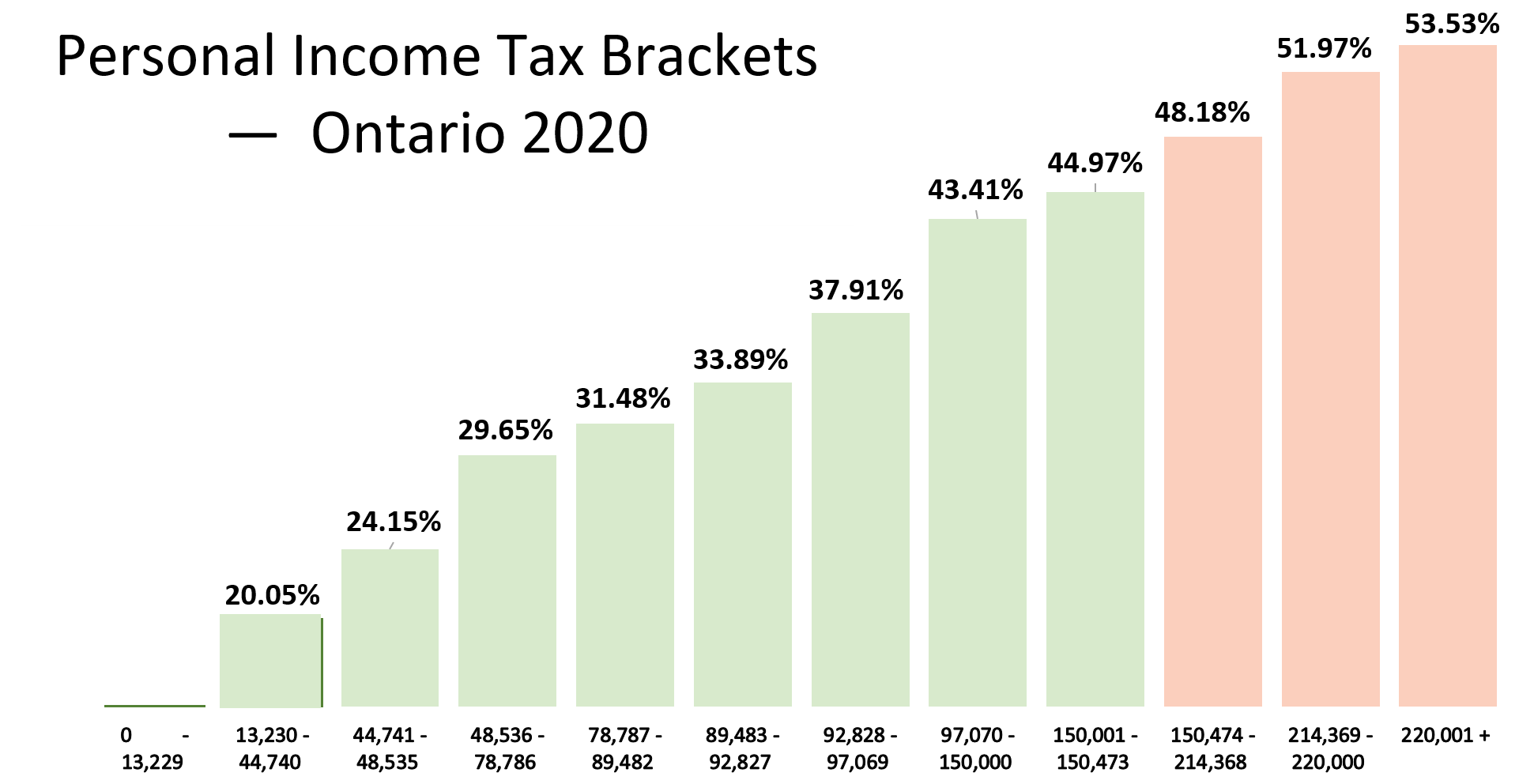

Canada Income Tax Brackets 2025. From $14,539 to $16,129 for taxpayers with net income (line 23600) of $177,882 or less. Find out the federal and provincial/territorial income tax rates and brackets for 2025, including surtax rates and thresholds.

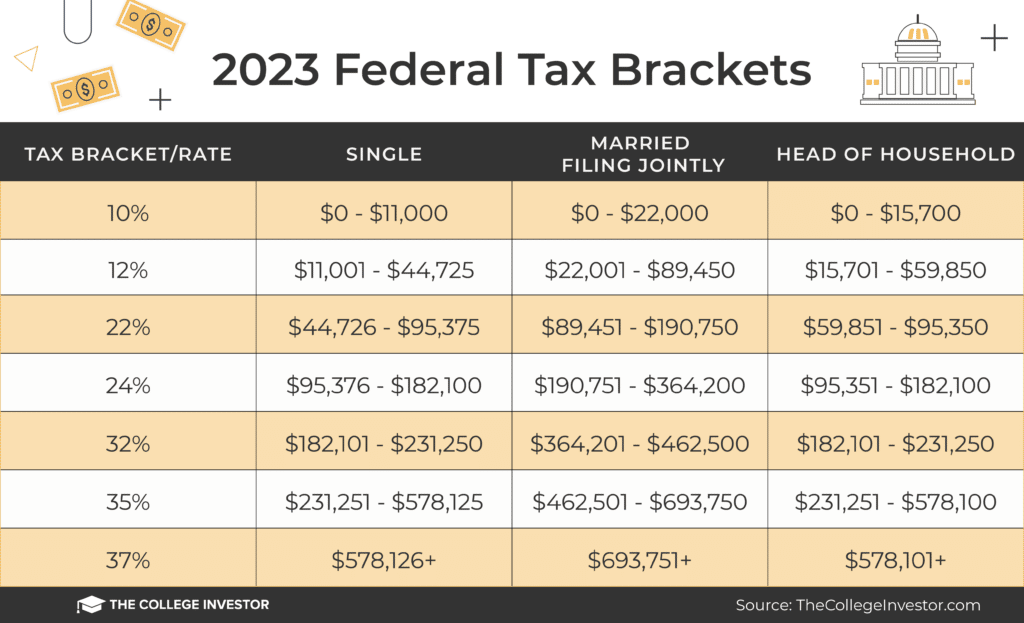

From $14,539 to $16,129 for taxpayers with net income (line 23600) of $177,882 or less. This applies to taxable income up to $57,375 in 2025. The canada income tax cut for 2025 focuses on the lowest marginal tax bracket, reducing the rate from 15% to 14%.

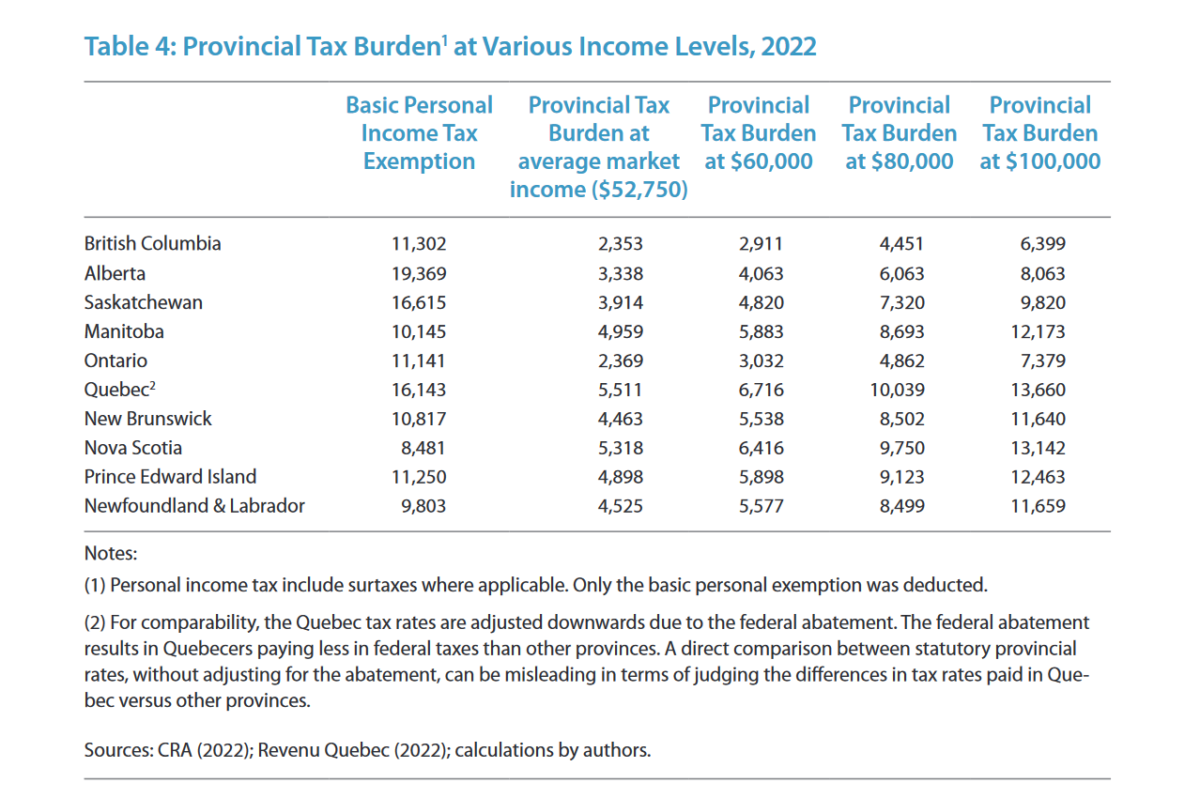

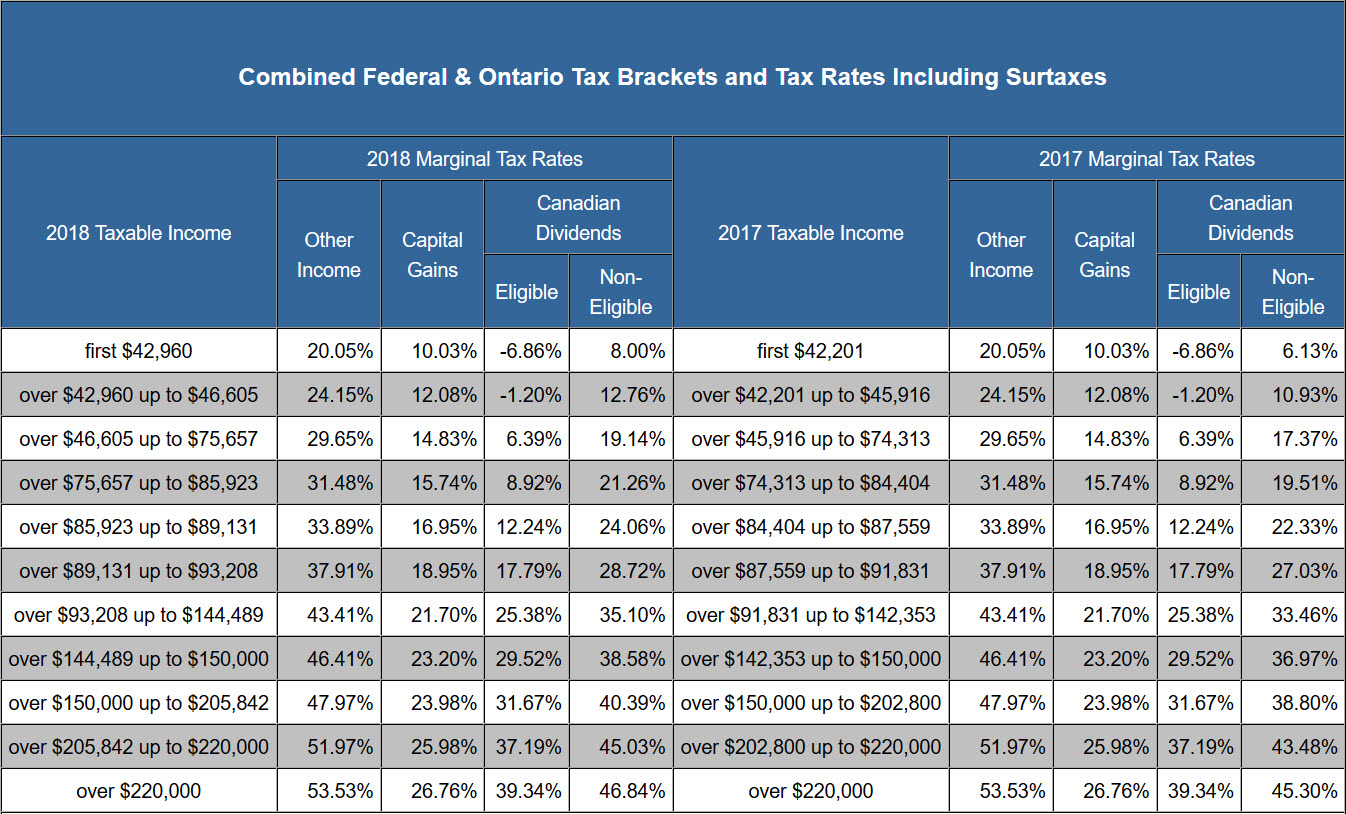

Find The Combined Federal And Provincial/Territorial Marginal Tax Rates For Each Tax Bracket In 2025 And 2024.

Find the latest income tax rates and brackets for 2025 from kpmg’s personal tax tables. From $14,539 to $16,129 for taxpayers with net income (line 23600) of $177,882 or less. See the combined tax rates for each taxable income.

See How Indexation, Personal Tax Credits, And Other Factors Affect Your Income Tax.

This applies to taxable income up to $57,375 in 2025. The canada income tax cut for 2025 focuses on the lowest marginal tax bracket, reducing the rate from 15% to 14%. Find out the federal and provincial income tax rates for 2025 in canada.

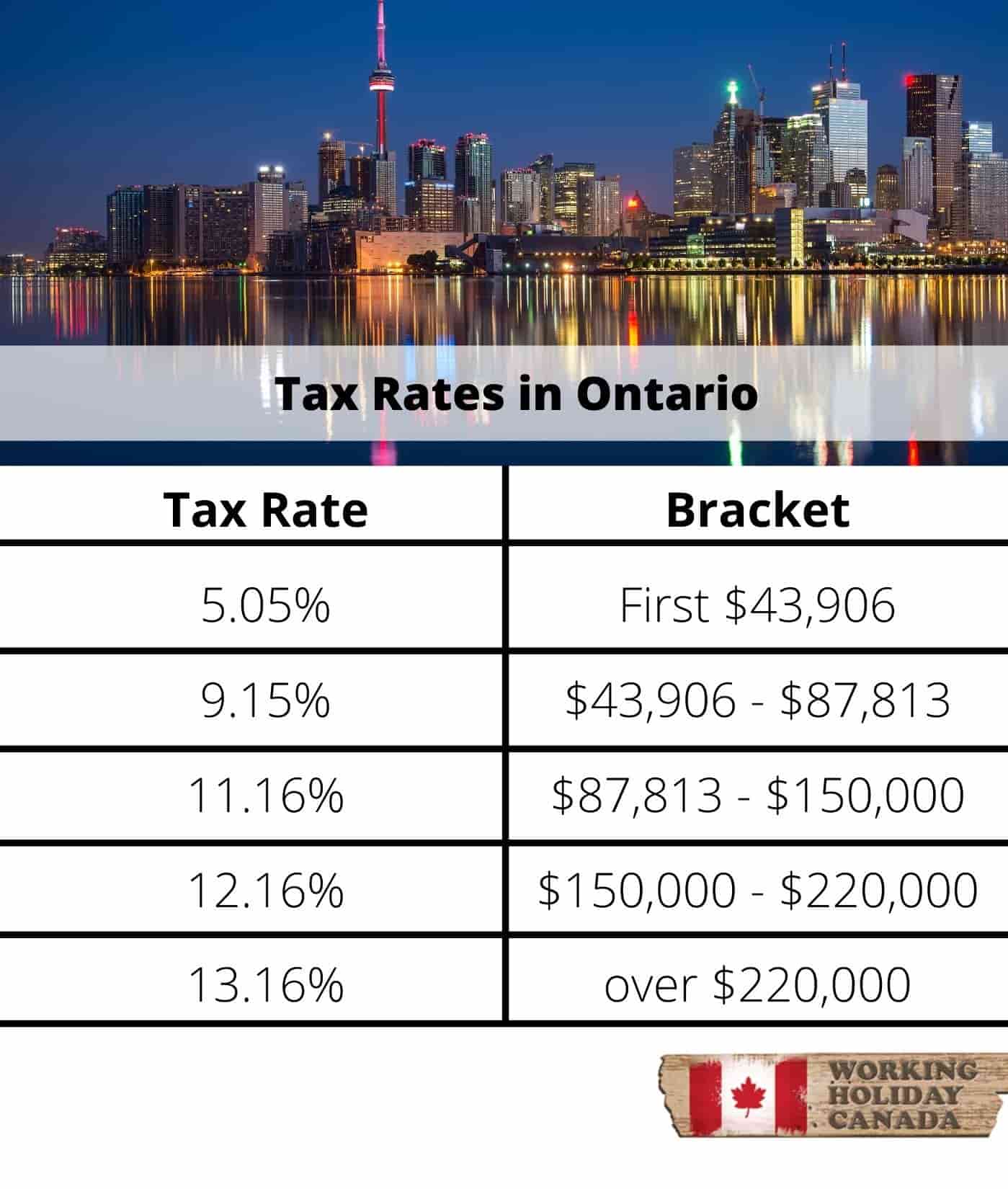

Find Out The Federal And Provincial/Territorial Income Tax Rates And Brackets For 2025, Including Surtax Rates And Thresholds.

For incomes above this threshold, the additional amount of $1,590 is reduced until it. Learn about the basic personal amount, social security contributions, and provincial.